Taxes and social security

When moving to the Netherlands, it is important to know whether you are considered resident tax payer or non-resident. Both residents and non-residents are taxed on their taxable income. A number of criteria help determine your status as resident or non-resident.

You can assume that, when you are living in the Netherlands and receive a Leiden University salary, you will be considered a resident. If you receive a grant from your country of origin, you may be seen as non-resident. If you are unsure about your taxpayer’s status, you can contact your HR department or a professional tax consultancy office. You can also find more information on www.belastingdienst.nl/english.

Tax support

Leiden University is unable to assist you in completing your tax return. However, we can facilitate an appointment with Dutch Tax Returns, a division of Limes International, at a discounted rate.

Limes International specializes in cross-border taxation and can provide assistance with various tax matters. Information regarding fees and terms is available at the Service Centre International Staff, and this information can be requested annually from mid-February. Starting from that point, you will have access to the Dutch Tax Returns portal, including a discount code for use during the online checkout process. The entire service will be conducted online, and your tax return will be processed based on the documentation requested by Dutch Tax Returns. If you wish to discuss your tax return or simultaneously file for your partner's tax return, a nominal additional fee will apply. Further specific information will be available through SCIS.

Wage tax

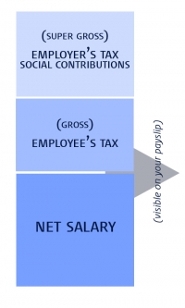

Leiden University pays tax over your salary. On your payslip you can see how much of your gross salary is paid to the Dutch tax office. On top of that, Leiden University has to pay employers’ tax and social contributions. Therefore, there is an essential difference between your gross and net salary.

In some cases after wage tax has already been withheld from your salary, you still need to complete an annual tax return depending on your partner's income, other income sources and the mortgage on your house. You might also be liable for tax deductions (e.g. mortgage interest).

Income tax

There are three types of taxes for taxable income.

-

Box 1: Taxable income from work and home

Income from employment, pensions, social security, income from home ownership, etc. The tax you pay in box 1 is defined over four rates. These tariffs are recalculated annually. -

Box 2: Taxable income from substantial interest

Income from a substantial interest in a company is subject to income tax at a rate of 25%. -

Box 3: Taxable income from savings and investments

Taxation on income from savings and investments is set on 4% of the assets. You cannot file a digital return for the year in which you move to the Netherlands. For your first tax return, the tax and customs administration requires you to complete a M-form.

30% facility

Under certain conditions the first 30% of wages are tax free if you're an employee from abroad. You need permission from the Belastingdienst to apply the facility. More on the conditions of the 30%-facility and how to apply >>

Social security

As an employee of Leiden University you will be insured against illness, disability, accidents at work and occupational illnesses and unemployment. You will also be covered by the schemes for old age pension, survivor benefit, and child benefit. When you are a scholar or are doing research on a stipend you might not always be covered by social insurance schemes. You can find more information on the website of the SVB.

Benefits (toeslagen)

If you live in the Netherlands and have health care insurance, a rented house or children, you might be entitled to a contribution towards the costs. This is called ‘a benefit’. The Dutch government offers various benefits. However, if you are not on a Dutch payroll you are probably only eligible for rent allowance, provided you meet the criteria. It is important to note that the Dutch government checks applications retro-actively. That means that if it turns out that you were not eligible for a benefit that you have received, you will have to pay back the amount received in full. You can find more information on benefits and how to apply for them on the website of the Belastingdienst.

ABP pension accrual

If you receive a salary from Leiden University, you automatically accrue pension with the Algemeen Burgerlijk Pensioenfonds (ABP). You can take out supplementary insurance at ABP for more financial freedom in your old age. In addition to a retirement pension, ABP also offers surviving dependents insurance and a work disability pension. You can find more information on ABP on the staff website and the ABP website.